LTV and Cloud Services: How Add-On Cloud Video Surveillance MRR impacts LTV

Customer Lifetime Value, or LTV, is a crucial metric for assessing the return on a recurring revenue business model. The reason is that most subscription-based businesses are designed to generate profitability over the long-term, not immediately upfront with a large one-time sale. So what is LTV and how is it calculated?

Customer Lifetime Value.

Customer lifetime value (CLV) represents the total dollar amount that a customer is worth to your business, taking into account their purchases from the first day they buy from you until their very last transaction.

Customer lifetime value is a massively powerful metric, and here’s why: tiny increases in CLV can lead to huge gains in overall revenue.

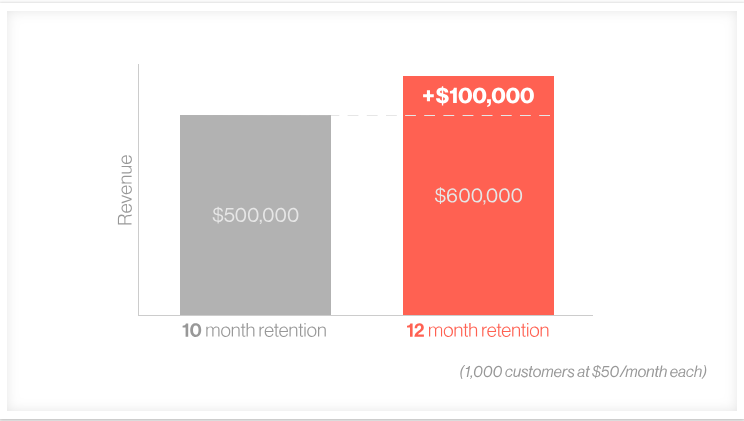

If your SaaS customers pay you $50 per month, and the average customer stays with you for 10 months, then your average CLV is $500.

With 1,000 customers, simply increasing that average to 12 months — just 20% — would add $100,000 in revenue to your business. Source: GrooveHQ

Customer churn rate is the rate at which a business is losing customers due to cancellations and is usually measured on a monthly basis. For example, a business might have a monthly churn rate of 2%, meaning 2% of their customers cancel (or do not renew) each month. There are various other types of churn concepts, such as either contractual or non-contractual. It can also be characterized as voluntary or non-voluntary depending on the cancellation mechanism. You can learn more about predictive models or types of churn at this article by Ruslana Dalinina @ Source: Oracle + Data Science

When assessing LTV, it’s crucial you take into consideration the Customer Acquisition Cost (CAC), which is commonly defined as:

The cost involved in acquiring one new customer. The easiest way to determine customer acquisition cost is to divide total sales and marketing expense by the number of new customers.

However, in the case of a growing SaaS business, with new customer acquisition on top of existing customer renewals and expansion business, it becomes trickier to accurately calculate CAC. Source: Lauren Kelley OpexEngine does a great job of defining the acquisition expense in a SaaS model.

In general, the CAC has to be less than your LTV — f you’re spending more on customer acquisition than you anticipate to earn from the customer in revenue, you will end up in a deficit, unless you have an unlimited budget to spend on acquisition… which most people don’t 🙂

LTV in a Cloud Video Surveillance Context

So how does all this relate to the video surveillance market? Alarm service and central monitoring stations have understood this business model for many years but as the SaaS business model moves into a larger number of traditional security installations, it’s crucial that installers and security solution providers incorporate these concepts into their business model. Many security integrators that provide camera setup, installation and local network back-up have calculated their revenue and profitability using a traditional model.

Typical Revenue for 6 camera + NVR installation:

Cloud Video Surveillance + LTV

In the instance above, the reseller made a profit of just over $1200.

MRR example:

One camera = $15/mth for cloud service x 6 cameras x 36 months (3 year contract) = $90/month.

Total $3200 for the life of the contact.

Your revenue now scales from ~20% profit on hardware and services to the MRR also gained with the add-on cloud services. You can now generate a much higher revenue over the life of the customer. This completely changes the profitability model for a typical installation while providing a more cost-effective solution to maintain and support throughout the life of the contract.

For integrators who are used to traditional security system/surveillance installs, this can be a big mind shift. Very often, they are simply breaking even or taking a loss on the hardware, in order to gain a long term customer. The goal of add-on cloud services such as cloud video surveillance in this context–is to also attach a recurring revenue in each install.

With the SaaS based cloud video surveillance model, it isn’t necessary to generate all your earnings at the time of the installation. The model shifts to viewing installations as part of your customer acquisition cost, which leads to greater LTV with MRR consistently being generated by long term customers.

Interested in adding MRR to your current surveillance or security business?

No Comments